2022, 2023 & 2024 - Boutique Manager of the Year

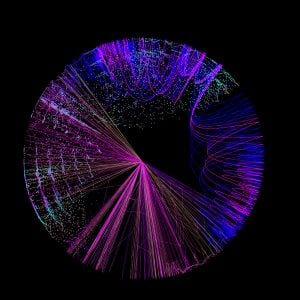

A smarter approach to sustainable investment

The Environmental Finance Sustainable Investment Awards are free to applicants and open to all organisations globally. These awards were given on 29 June 2022, 28 June 2023, and 28 June 2024, and relate to the annual period May 21-May 22, May 22-May 23 and May 23-May 24.

About Us

Through proprietary research, advanced analytics, and deep environmental insight, we help investors align portfolios with the global transition to a sustainable economy. We work with institutional and wealth clients worldwide to deliver financial performance alongside measurable positive environmental outcomes.

As a cross-asset sustainability specialist, Osmosis leads with innovation, responsible stewardship, and an unwavering commitment to supporting the environmental transition, empowering investors to build a resilient and sustainable future.

We target three pillars of impact

Superior Risk-Adjusted Returns

Environmental Impact

Active Ownership

A Smarter Approach to Fossil Fuel Divestment

Balancing Financial Performance and Fiduciary Duty

Environmental Research

Our objective approach to environmental investment is driven by over a decade of proprietary research enabling the construction of our proprietary sustainable investment factor. Research, both internal and external, has demonstrated that our Resource Efficiency factor is uncorrelated to other common factors and is a predictor of future firm value.

As companies globally set increasingly ambitious Paris aligned or Net Zero targets, our objective research process effectively measures a company’s sustainable action vs its sustainable intent. In order to meet our clients’ goals, we utilise this sustainable investment factor as the core source of financial and environmental return across all of our funds and strategies. Our portfolios overweight efficient companies and underweight, or short, inefficient companies, while targeting specific risk profiles and investment styles.

Importantly, all our portfolios demonstrate significantly less ownership of Carbon, Water and Waste than their respective benchmarks.

Resource Efficiency

Enables high-quality companies with strong management teams to generate a competitive advantage

Captures the intangible value of environmental resilience and mitigates long-term climate change risk

Identifies companies that are transitioning to a greener economy and have lower environmental risks

$17.9bn

assets under management

as of 30 June 2025

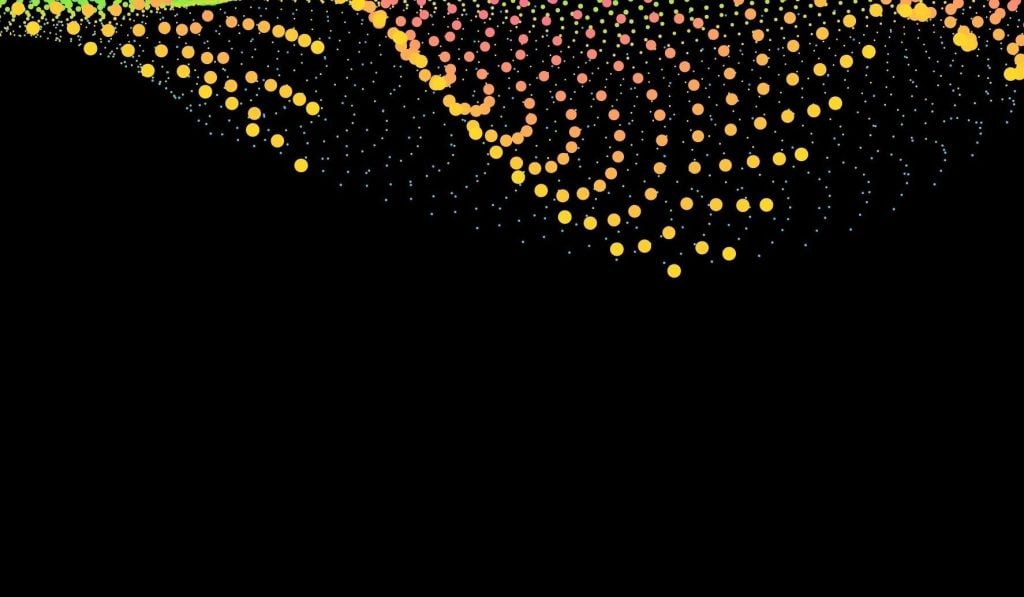

Our Environmental Impact

The Resource Efficiency Signal generates a significant reduction in the resource footprint of all our portfolios relative to their benchmarks. Osmosis’ strategies save an average reduction of 54% in carbon, 73% in water, and 53% in waste, relative to their benchmarks (as of 30 June 2025).

-54%

in Co2e emissions

-73%

water consumption

-53%

waste generation

9 sustainable

investment strategies

The Hidden Carbon Cost of Water and Waste Mismanagement

Mismanagement of waste and water is not just an environmental issue but a major driver of emissions

Fixed Income: Credit Quarterly Outlook

July 2025 – By Victor Verberk, CEO/CIO, and Bob Stoutjesdijk, Strategist